Why Canadian Startups Fail to Scale

Despite the abundance of talent and ambition emerging from top universities like the University of Waterloo and the University of Toronto, Canadian startups often fail to make a significant impact on the Canadian economy. In the past decade, the United States has seen the emergence of 656 unicorns, compared to only 21 in Canada (World Population Review). Surprisingly, the root cause isn't a lack of talent or ambition but systemic issues within Canada’s support ecosystem for startups and a broken "startup funnel".

The Canadian Economy is Lagging

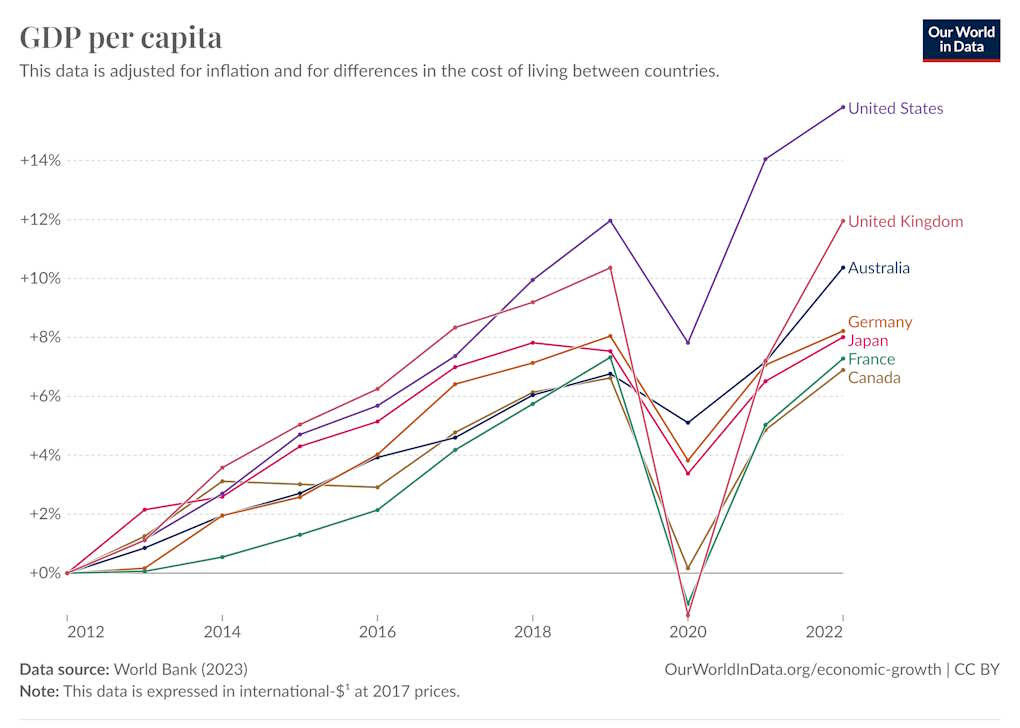

Canada has the 10th largest economy globally, with a GDP of approximately $2 trillion in 2023. In contrast, the United States has the world's largest economy, with a GDP of about $20.8 trillion in 2023 (Georank.org) (Wikipedia). Over the past decade, Canada's economic growth has been relatively stable, but it has not matched the rapid growth seen in the United States. This economic disparity highlights the challenges Canadian startups face in competing on a global scale.

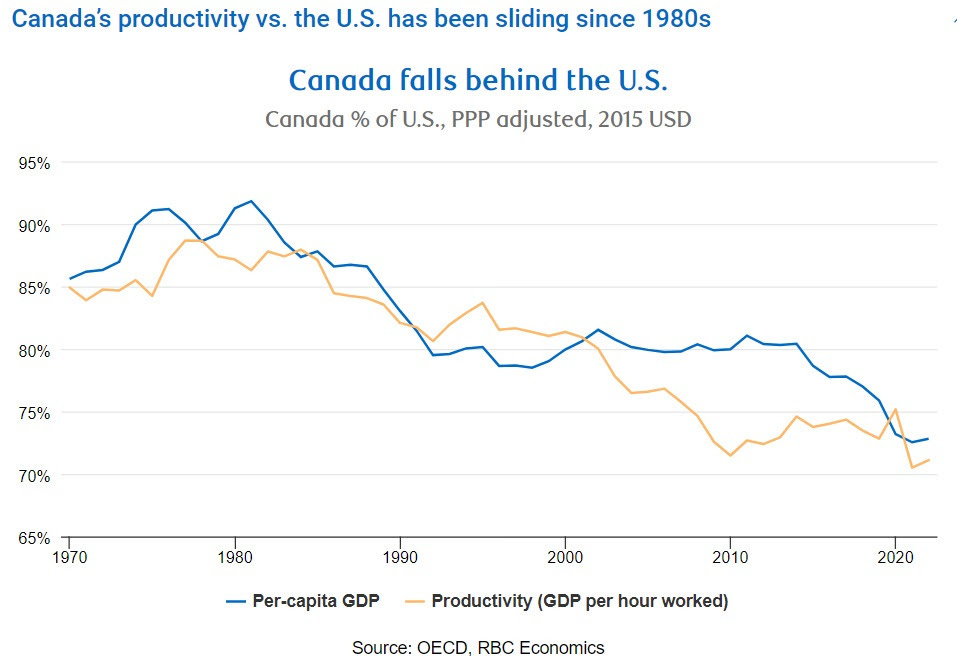

Relative productivity is similarly on the decline.

The Role of Government Startup Support Programs

The Canadian government offers various support programs aimed at helping startups. Selected programs include:

Scientific Research and Experimental Development (SR&ED) Tax Incentive Program: This program provides tax credits and refunds to businesses conducting R&D in Canada. In 2021, the SR&ED program cost the federal government approximately $3 billion annually (Wikipedia).

Industrial Research Assistance Program (IRAP): Managed by the National Research Council, IRAP offers funding and advisory services to innovative small and medium-sized enterprises (SMEs). In 2020-2021, IRAP had a budget of $318 million (Wikipedia).

Canada Small Business Financing Program (CSBFP): This program helps SMEs obtain loans by sharing the risk with lenders. As of 2021, the CSBFP facilitated approximately $1 billion in loans each year (Wikipedia).

While these programs aim to support startups, they often create a comfort zone that prevents companies from scaling effectively. The initial barriers to starting a company in Canada are low, allowing many to begin operations with minimal funding. However, once the company gets the initial injection of money, its path should be simple: find a product-market fit and make money or fail.

Unfortunately, the local ecosystems prevent companies from failing and let them survive for years on government rebates and loans without completely failing. The government concentrates the capital to keep companies afloat instead of helping to promote potential winners. Local founders get stuck in this bubble, chasing small-scale support that keeps their companies afloat for years. If a company doesn’t have a product-market fit, it should fail quickly. Just because it’s doing R&D, it shouldn’t be eligible for credits and rebates.

On the other hand, companies that have a product-market fit should be allowed to scale quickly. But there is no local capital to help them accelerate.

Lack of Venture Capital

One of the most significant challenges for Canadian startups is the lack of a robust venture capital ecosystem. In 2022, venture capital investments in Canada totaled approximately $7 billion, compared to $330 billion in the United States (NationMaster). This is a 47x difference in funding versus a 10x difference in GDP. This stark difference highlights the limited availability of growth funding in Canada, forcing many startups to seek investment from U.S. venture capitalists.

The Path Forward

The key changes the government needs to implement are unfortunately against the common Canadian philosophy of "being nice" to everyone. They need to restructure the programs to produce a large top-of-the-funnel of startups, allow bad companies to fail, and bring capital to hyper-scale the successful companies from one stage to the next.

Here are a couple of concrete possible changes:

Restructure Early-Stage Funding: The Canadian government should simplify the process of providing early-stage funding ($100k) to startups in exchange for a small percentage of equity. Run a series of national “accelerators.” Make it simple to hit the ground running.

Create a Support System for Growth: Beyond the initial funding, there needs to be a system that supports startups through subsequent stages of growth. This could involve bringing Silicon Valley venture capitalists to Canada. It can also provide local founders with travel stipends to go to the U.S. to raise funds. A stipend of $50k should cover at least two key trips (one pre-funding to network and create a strategy, and the second trip for the actual fundraise). In many cases, the second trip is not even required as more investors are comfortable hearing pitches remotely, but the founders need to spend some time developing their networks.

Involve Experienced Entrepreneurs: One of the consistent mistakes I see from the government is the involvement of MBAs or local not necessarily successful founders. Instead, the programs designed to support startups should be run by entrepreneurs who have demonstrated firsthand experience in building and scaling companies.

Promote International Exposure: Canadian startups need to think beyond the local market, which is not large enough to support significant growth. They should not even try to sell locally. They can operate locally but need to sell globally from day one.

Reevaluate Support Programs: While SR&ED credits and other similar programs are beneficial at later stages, they should be lightweight and focused on helping startups achieve profitability. The emphasis should be on creating an environment that supports dynamic growth rather than maintaining the status quo.

To summarize: (1) reduce the credits and various support programs (reuse the money for the programs below), (2) offer $100k starter funding to qualified companies and take some equity (create top of the funnel), (3) give $50k travel stipends to help raise capital internationally (support great companies to go to the next phase), and (4) add capital with easy-to-operate matching programs when a company raises a subsequent round (versus requiring them to submit tedious paperwork for rebates) (investors would love to get “free” matchings; make it easier for them to engage with Canadian companies).

The focus should shift from maintaining a large number of small, stagnant businesses to fostering a dynamic ecosystem where startups can thrive and achieve significant impact.

As someone who grew up in Canada, went to the University of Toronto, but has only ever worked and built (unsuccessful) businesses in the US, this is some interesting food for thought.

My two immediate followups are:

1. Analyzing Israel might be Israel since they seemingly manage to overcome this challenge.

2. Canadian companies like NordSpace with longer-term research initiatives and no short-term PMF really do need SR&ED, where/how would that fit in?

I see similar patterns in Korea